Credit is the availability or access to money that you have not yet earned. In this way, credit is your ability to borrow money from a bank, lender or creditor with the promise of paying them back.

How well you meet that promise to pay back borrowed money, or your creditworthiness, is collected by private reporting agencies in your credit history and report. Banks, lenders, and creditors voluntarily report this information and it is used to calculate your credit score.

Credit scores can be used to:

- Assess your borrowing eligibility

- Determine your interest rate on loans (auto, home, etc.)

- Calculate your insurance rates

- Evaluate risk of non-payment by prospective landlords

If you’d like to meet with a financial wellness counselor in One Stop Student Services to talk about credit and your specific needs, schedule an appointment.

Tips for building good credit as a student

What can you do now to help build your credit?

- Only borrow what you need - try not to borrow any more loans than are necessary for your educational and living expenses. Keeping your debt as low as possible will positively impact your credit. If you have questions about budgeting for your loans we are here to help!

- Living off campus? Be sure to pay your rent and utilities on time! Paying bills by their due dates help build a good credit history.

- If you have a credit card try not to carry a balance. Paying off your credit balance every month will prevent you from paying interest on your charges.

- To avoid late fees, make at least the minimum payment every month. However, you will still need to pay interest on the remaining balance.

- Don’t apply for credit cards just to get a discount. Many retail stores have credit cards which will give you a discount just for applying. But, whenever someone checks your credit it negatively impacts your credit score, even if you are declined for the card. Apply for credit cards sparingly.

- If you have student loans take advantage of auto-pay once you are in repayment. You will set this up through your lender and makes sure your loans are paid on time each month.

What is a credit report?

A credit report gives your credit history, i.e. a list of your accounts (past and present) and how you manage them. The report will include, but is not limited to:

- Current balances

- Payment history

- Any past due information

- Age of accounts

A credit report is like your financial or borrowing resume.

The main purpose of a credit report is to determine if you’ll pay back what you borrow. People with bad credit can still get approved for additional credit, but most often they will have to pay more for the risk the lender is taking by loaning them money. This can lead to higher interest rates. Alternatively, good loan and debt management practices can help you build good credit, which can positively impact how lenders evaluate your credit risk.

Checking your credit report

It is recommended that you check your credit report at least once a year to ensure accuracy - be sure to report any errors immediately. This can be a good way to find previously unnoticed cases of identity theft. You are entitled to a free copy of your credit report once per year from each of the three major credit bureaus: Equifax, Experian, and TransUnion.

What is a credit score?

Your credit score is a snapshot in time (like your GPA), taking into account a variety of financial factors. This number is a good indicator of both your credit history and potential risk.

- 740-850: Excellent credit

- 690-739: Good credit

- 630-689: Average/fair credit

- 300-629: Bad credit

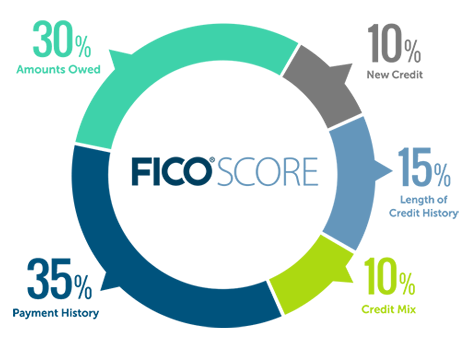

What makes up your credit score? (Chart from MyFico.com)

Using credit cards responsibly

For students, credit cards can be a convenient tool and smart usage can help you build a healthy credit score. However, credit cards can be a very destructive financial force if not used wisely. Credit cards should not be used to finance debt as credit card interest rates are among the highest.

The Credit Card Accountability Responsibility and Disclosure (CARD) Act of 2009 set new protections for credit card users. If you are under the age of 21 and want to open a credit card account, you will need to show that they can afford to make payments. Otherwise, credit card companies will require a cosigner who is 21 or older.

Pros for credit cards:

- Can help increase credit score

- More protection against fraud for purchases

- Convenience

- Pay later for purchases made now

- Automatically keeps a record of purchases - helpful for budgeting

- Good for emergencies

Cons for credit cards:

- High-interest rates

- Consequences for not paying full balance

- Impact on future loans/mortgages/car loans

- Possible hidden fees

- Easy to overspend

- Under 21 rule of credit cards (from the CARD act of 2009)

Tips for using credit cards:

- Keep track of your spending

- Stick to your budget, remember you will have to pay for your purchases later

- Set reminders to pay your bill/balance

- Make sure to read all terms carefully

- Pay your balance on time and in full each month

- Stay well under your total credit limit

Additional resources

Disclaimer: The University of Minnesota does not endorse, support, share a point of view or personal or political opinion, or have any involvement in the business, activity, movement, or program of third-party websites, tools, apps, or resources listed on this page.