Banking is the foundation of personal finances. It is the services offered or the business conducted by a bank, a financial establishment that takes deposits, issues loans, and exchanges money on your behalf. Familiarity with banking concepts can help you navigate important decisions throughout your life. A basic checking account, and possibly a savings account, can make it easy to keep track of your finances as you earn, receive, exchange, spend, and save your money. Read more about deposits, spending, and the common types of bank accounts below. More information about budgeting and spending is also available.

If you have questions, or would like to talk with a financial wellness counselor about your specific needs, schedule a financial wellness appointment with One Stop Student Services.

Direct deposit

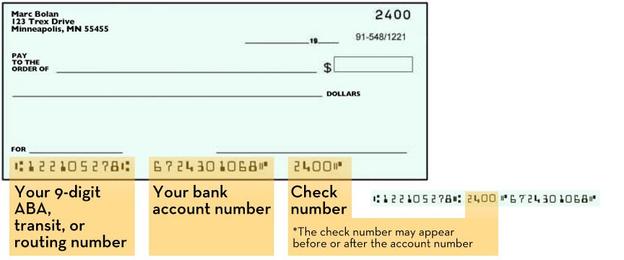

Direct deposit is a process that most banks, universities, and employers use to send funds directly to your bank account. This allows money to get to you quickly and efficiently, and eliminates the process of paper checks, which can be less secure than utilizing direct deposit. When setting up direct deposit, you will be asked to provide the account number and routing number that is provided by your bank, or found on your checks, to set up direct deposit.

Specific to being student at the University, we recommend that you set up direct deposit. This way any refund owed to you from your student account will be sent seamlessly. The University finds that students relocate fairly often; to minimize paper checks being sent to wrong addresses, direct deposit is strongly encouraged. Note that setting up a direct deposit account as a student for refunds is not the same as setting up direct deposit for earned money such as through student employment.

Types of bank accounts

Checking account

A checking account is a main account into which you deposit money and out of which charges are drawn. There should generally be enough money in your checking account for what you need to pay for without overspending (possibly incurring overdraft fees). Debit cards and checks are linked to checking accounts, and can be used to make purchases.

Savings account

A savings account is similar to a checking account, but accrues interest for the money in the account. A savings account is a little less “liquid” than a checking account, meaning it is not ideal for making a lot of transactions in a short amount of time. There may be transfer or withdrawal limits each month that prevent high transaction activity.

529 college savings plan

A 529 plan is a tax-advantaged savings plan designed to encourage saving for future college costs. How plans are structured and how to access funds from the plan varies by state, plan administrator, and the plan itself. If you already have a 529 plan, learn how to submit payments.

Money market account

A money market account is a more complex form of a savings account. It generally accrues interest at a higher rate than a savings account, but also has higher minimum balance requirement. There are more restrictions on withdrawals, so it is even less liquid than a savings account. A money market account could be used to maintain an emergency fund, but it is intended for longer-term savings, usually after a regular savings account has been funded to your satisfaction.

Certificate of Deposits (CDs)

A certificate of deposit, or CD, is another form of savings, but generally pays higher interest than a savings account. It is used when you don’t need to access your money for 6-12 months. The longer the duration of the CD, the higher amount of interest it will earn. There are penalties for taking money out of a CD early, so it is best used when you have a savings cushion already in place, or are sure you will not need access to the funds in a CD.

Saving an emergency fund

Saving is an important part of banking and overall financial goal setting. It is a practice used to set aside money in preparation for the future, to meet short and long-term goals.

Your emergency fund can be a safety net for unexpected events, such as losing income from a job, repairing your car, a medical emergency, or short-notice expenses. An emergency fund helps you avoid going into or adding to your debt, which is a benefit to your overall, long-term financial wellness. You may find that you do not currently have the financial capability to begin an emergency fund due to personal circumstances. This is understandable. It is generally good to be aware of the benefits of emergency funds, and practice putting away money in any amount when you can.

An ideal emergency fund includes enough money to cover your expected expenses for roughly three months. You can consider a three-month emergency fund a financial goal, but having some money set aside is what is most important. Additionally, your emergency fund money should be easily accessible to you so that you can obtain it exactly when you need it without being penalized for withdrawal.

Additional resources

- Net Worth Statement (pdf)

- Money market accounts (article)

- Credit union vs. banks (article)

- How to choose a savings account (video)

- Rockstar Finance (tool)

- Effective U: Learn more about managing your money

Disclaimer: The University of Minnesota does not endorse, support, share a point of view or personal or political opinion, or have any involvement in the business, activity, movement, or program of third-party websites, tools, apps, or resources listed on this page.